Falling behind on mortgage payments can happen for all kinds of reasons. Job loss, illness, injury and other circumstances can make it challenging to get by. The thought of losing your home can be devastating, but there are steps you can take to stop foreclosure and stay in your home. Texas has one of the fastest foreclosure processes in the United States, so if you’re unable to pay your mortgage or you’re already behind on payments, it’s important to act fast and seek the counsel of an experienced foreclosure attorney as soon as possible.

What Is Foreclosure?

Foreclosure is the legal process in which a lender reclaims mortgaged property, usually when a borrower fails to make payments. Foreclosure proceedings may also be initiated when a borrower owes money on a home equity line of credit, home improvement loan, back taxes or to a homeowners’ association.

Most foreclosures in Texas are non-judicial, which means lenders may proceed with foreclosure without first obtaining a court order. When you buy a house in Texas, you’ll probably sign two documents: a promissory note and a deed of trust. The promissory note is your “promise” to repay the loan according to the repayment terms. Much like a mortgage, the deed of trust gives the lender a security interest in the property. The deed of trust will most likely include a power of sale clause, which gives the lender the right to take and sell the home non-judicially to recoup the money loaned to you.

What Are My Rights Before Foreclosure Proceedings Begin?

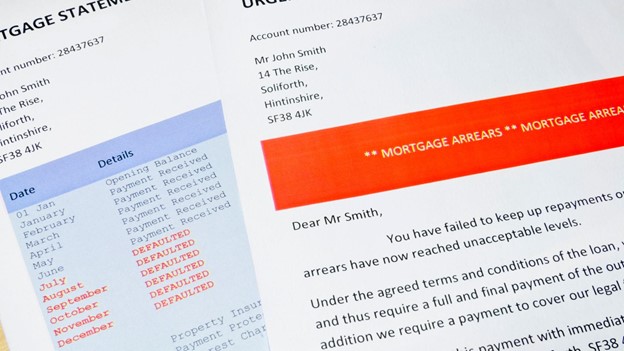

Most mortgage loans offer a grace period of ten to fifteen days from the due date before you’ll incur charges for a late payment. If you miss several mortgage payments, your lender will send letters and call to find out if and when you can pay. Federal mortgage service laws require lenders to attempt to contact you by phone to discuss alternatives to foreclosure within the 36 days of a missed payment and again within the 36 days following each missed payment.

No more than 45 days after a missed payment, the lender must inform you in writing about loss mitigation options such as loan modification or forbearance and assign a professional to help you explore those options. If you file bankruptcy or tell the servicer not to contact you, loan servicers are not required to take these actions. Although moratoriums have helped homeowners avoid foreclosure during the COVID-19 pandemic, most of them have ended. However, if you’re still experiencing economic hardship due to the pandemic, contact your loan servicer or the appropriate government agency if you have a FHA, VA or USDA loan to find out about available options for relief.

The Foreclosure Bankruptcy Process in Texas

Notice of Default & Intent To Accelerate

In Texas, it can take just a few months of missed payments for a lender to put your loan in default. Regardless of the reason you may be facing foreclosure, it’s critical to take action as soon as you receive a Notice of Default and Intent to Accelerate from your lender. This notice informs you that you have failed to pay the required amount on your property and that the amount due is payable immediately upon sale. The lender must give you at least 20 days to cure the default before a notice of sale can be given.

Notice of Sale

After the cure period has passed and there is at least 21 days before the foreclosure sale, the lender sends a notice of sale to the borrower. It will also be filed with the county clerk and posted in the courthouse in the county where the property is located. The notice of sale must include the date, time and location of the sale. In Texas, foreclosure sales take place on the first Tuesday of every month — even on holidays. A representative of the creditor will sell the property to the highest bidder.

Eviction

Once the sale is complete, the new property owner can file an eviction notice, which may only give the former owner five days to vacate the property or file an appeal.

What if I Don’t Want to Keep My Home?

Even if you’re not interested in staying in your home, it’s worth making the effort to prevent foreclosure. If your home is sold for less than what you owe, you’ll receive only partial credit against the outstanding balance, and you can still be sued for the remainder of the balance. Filing bankruptcy can be a viable solution to avoid this situation.

What Is Reinstating?

A borrower may pay the overdue amount, plus fees and costs, to bring a loan current and reinstate it within 20 days after the servicer mails the Notice of Default and Intent to Accelerate. If you signed a deed of trust when you took out the loan, it might also provide you with additional time to complete a reinstatement before the sale happens. It can be challenging to decipher the language in loan documents, so it’s best to consult a foreclosure attorney who can review them and advise you of your options.

Preventing Foreclosure

Once the property is sold, you likely have no remedy for recouping any money or getting your home back. Being proactive and taking steps to prevent foreclosure gives you more options that can help you keep your home or allow you to sell it yourself. You should always open every piece of mail you receive from your mortgage loan servicer, lender, creditors and local tax authorities.

It can be tough to face these issues, but when you’re armed with the information you need, you may find that options such as a loan modification or forbearance plan are available. You can also halt or delay foreclosure proceedings by declaring bankruptcy in Texas.

How a Texas Bankruptcy Lawyer Can Help

As soon as a bankruptcy petition is filed with the court, an automatic stay is put in place on most collection actions, including foreclosure. Stopping the foreclosure process gives you time to consider your options and make financial decisions that will best meet your needs. Your foreclosure lawyer can help you understand all the solutions that may be available to stop foreclosure and improve your financial situation.

If you want to stay in your home, your attorney may recommend Chapter 13 bankruptcy. Your lawyer will assist you in creating a manageable plan to restructure your debt, which will be repaid over a period of three to five years. As long as you follow the terms of the repayment plan, you won’t have to worry about lenders initiating foreclosure proceedings.

If you’ve opted to give up your home, Chapter 7 bankruptcy may be an effective solution to help you get out from under debt. This type of bankruptcy discharges most debts and can give you a clean financial slate. Chapter 7 bankruptcy can also help you avoid being sued if there is a remaining balance on a loan after a foreclosure sale.

Contact a Texas Foreclosure Lawyer Today

For more than 15 years, the foreclosure attorneys at Leinart Law Firm have helped clients throughout North Texas save their homes and get their finances back on track. Our experienced attorneys can help you navigate all aspects of foreclosure and bankruptcy and take some of the weight off your shoulders. Please use the convenient contact form or chat feature on our website or email us to schedule a complimentary consultation with a bankruptcy lawyer.