Your Dedicated Bankruptcy Attorney

Filing for bankruptcy is a difficult decision to make as it comes with long-term consequences. However, there are advantageous reasons to file for bankruptcy. The process is a complicated one, which is why you should consult our Dallas, TX bankruptcy lawyer when you’re ready to discuss your options.

With the help of our attorney, we will evaluate everything that has to do with your finances to determine whether filing for bankruptcy is your very best option, or if you can possibly avoid filing. Sometimes, you just need to restructure your debts or find a repayment plan that works best for you. Other times, filing for bankruptcy is your best option because you do not have a high amount of assets and it will not harm your life too much to file.

No matter what, having knowledgeable legal guidance is a crucial part of the filing process. Contact Leinart Law Firm today to enlist our 15 years of experience.

Table of Contents

Reasons That People File For Bankruptcy

Filing for bankruptcy is not a personal failure. Though it can be due to improper spending that some people file for bankruptcy, like misuse of credit, that is not always the case. In fact, for many people who file for bankruptcy, it is a choice that they are forced to make. Some people who are financially responsible end up declaring bankruptcy. Some of the top reasons that people file for bankruptcy are high medical bills, a personal injury accident, losing a job, and other unforeseen circumstances.

Things To Consider Before Declaring Bankruptcy

Bankruptcy is not a decision that you decide on overnight. You need to carefully think it over and assess your financial situation. Consider the type of assets you have, whether you have dischargeable debt, or whether there are other less drastic alternatives like revising your budget or credit counseling. You should only declare bankruptcy if you have no other alternatives to help your debt situation and improve your finances. Before you commit to a decision, talk to a trusted and qualified bankruptcy lawyer. They will analyze your situation and give you an honest professional opinion.

Once you decide to file for bankruptcy, there is no backing out. To learn more about whether bankruptcy is right for you, meet with an experienced bankruptcy lawyer now.

How Our Bankruptcy Lawyer Can Help You

A bankruptcy lawyer is a legal professional who helps individuals and corporations file for bankruptcy. In most cases, the attorney will act as a mediator between the debtor and creditors. The lawyer may also determine whether filing for bankruptcy is the best option in a given situation.

The types of services offered by bankruptcy lawyers can vary widely. For example, some lawyers will help clients prepare for meetings with creditors, while others will represent clients at these meetings. Other lawyers will help clients draft necessary documents, such as petitions and schedules. In addition, some attorneys might provide advice about the merits of filing for bankruptcy.

Bankruptcy lawyers will typically help people file for bankruptcy relief under the Bankruptcy Code. They help businesses reorganize and restructure their debts, as well as represent individuals who are unable to pay their bills.

Choosing What Kind Of Bankruptcy To File For

Your lawyer will be helpful in determining whether it will be in your best interest to file for Chapter 7 bankruptcy or Chapter 13 bankruptcy. In Chapter 7 bankruptcy, you file and all of your debts are wiped out. Keep in mind that it is incredibly difficult to get student loans wiped out, however, so those debts may need to be looked at and restructured in a way that you can pay them off. Chapter 13 bankruptcy is often used by people who want to keep many of their assets. It is more of a restructuring process and will allow you to keep much of what you have, rather than selling it to pay off your debts. Chapter 13 is also good for someone who can figure out how to pay off his or her debts, rather than filing and needing everything completely wiped off to create a clean financial slate. You will still get a lot of help for filing, but it allows a bit more flexibility and less repercussions for filing. Your bankruptcy lawyer in Dallas will be able to assist you to figure out what the best option for you will be.

The type of bankruptcy that you file for depends on your eligibility and circumstances. Everyone has a unique situation, so the type of bankruptcy you file for also depends on the goals you are trying to achieve. For example, if you want to get through the bankruptcy process faster, then you may want to see if you are eligible to file for Chapter 7 bankruptcy. It also depends on the state of your finances, and the types of assets or debts you have. A homeowner may want to file for Chapter 13, because it temporarily stops the foreclosure process. If you don’t know how to figure out the type of bankruptcy to file for, schedule a consultation with a trusted and experienced lawyer.

Chapter 7 Bankruptcy

Any time someone owes money and cannot pay it back, they can file for bankruptcy. There are several different kinds, but most people will only qualify for one. The main types are Chapter 7, Chapter 11 and Chapter 13 Bankruptcy.

Chapter 7 Bankruptcy is commonly called “liquidation bankruptcy” because the court sells down a person’s assets to pay off their debtors. A trustee will oversee the liquidation of assets, which can include real estate, cars and other items of value.

The biggest problem with filing for Chapter 7 Bankruptcy is that there are exceptions to what can be sold off. These exemptions vary from state to state, but may include essential household items like furniture and appliances as well as clothing and tools used for work.

As with personal bankruptcy, Chapter 7 bankruptcy still applies to businesses. When you file Chapter 7 bankruptcy for your business, it means liquidating everything. You’ll have to sell off all the assets of your company in order to satisfy your creditors, and you’ll have to make sure you use the money you generate from these sales to pay off both creditors and investors.

Chapter 11 Bankruptcy

When you declare personal bankruptcy, you have the options of Chapter 7 and Chapter 13 bankruptcy. If you’re dealing with a business, you can file Chapter 11 instead. When you file Chapter 11 bankruptcy, you’re essentially committing to a restructuring to ensure profitability. This means your company doesn’t go out of business. However, it does mean that you’ll have to make sure all your major business decisions are approved by a special bankruptcy court.

When you file Chapter 11 bankruptcy, you may be able to continue managing your business and the day-to-day operations, but your company will be shaken up and the courts will be involved to ensure you’re back on track to turning a profit.

Declaring Bankruptcy For Your Business

Unfortunately, businesses go under – but with the help of a bankruptcy lawyer, you can better understand your next steps and make sure your bankruptcy is as painless as possible.

If your business is failing, it may be time to fold. But that doesn’t mean you should panic. When you started your business, you knew this was a possibility, and whether you prepared for the worst or not, the possibility was always at the back of your head. Fortunately, the right bankruptcy lawyer can walk you through your options and help you figure out what kind of bankruptcy is best for your situation.

Bankruptcy doesn’t always mean that everything is over. Read on to learn a little more about your options and how they may affect your business.

When your business is on the rocks, you can declare bankruptcy just as you would for your own finances. However, there are a few key differences. While some elements of business bankruptcy look similar to personal bankruptcy, it’s important to remember that there are investors and founders to keep in consideration. You’re not dealing with your own money, but rather with the money of everyone involved in the business.

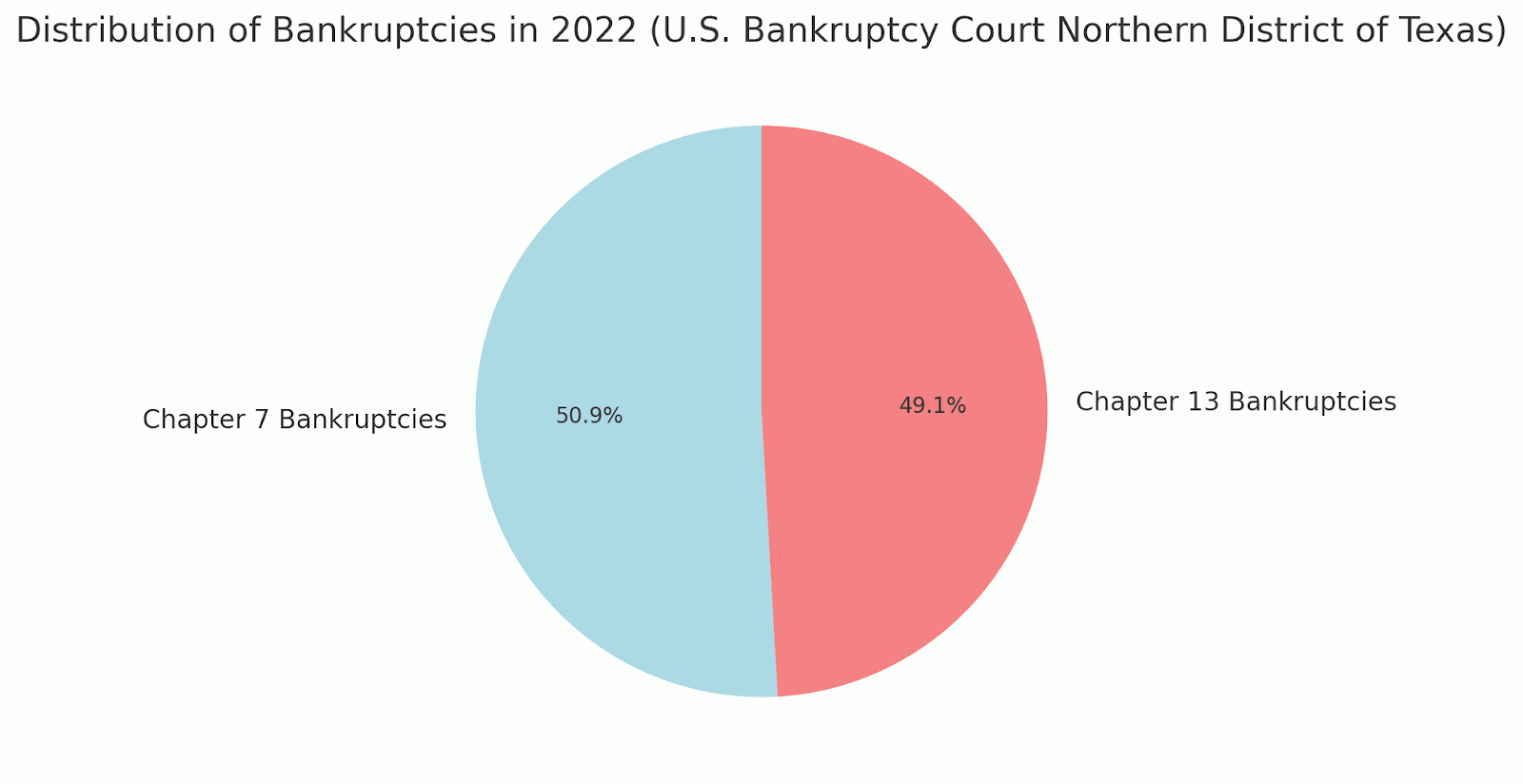

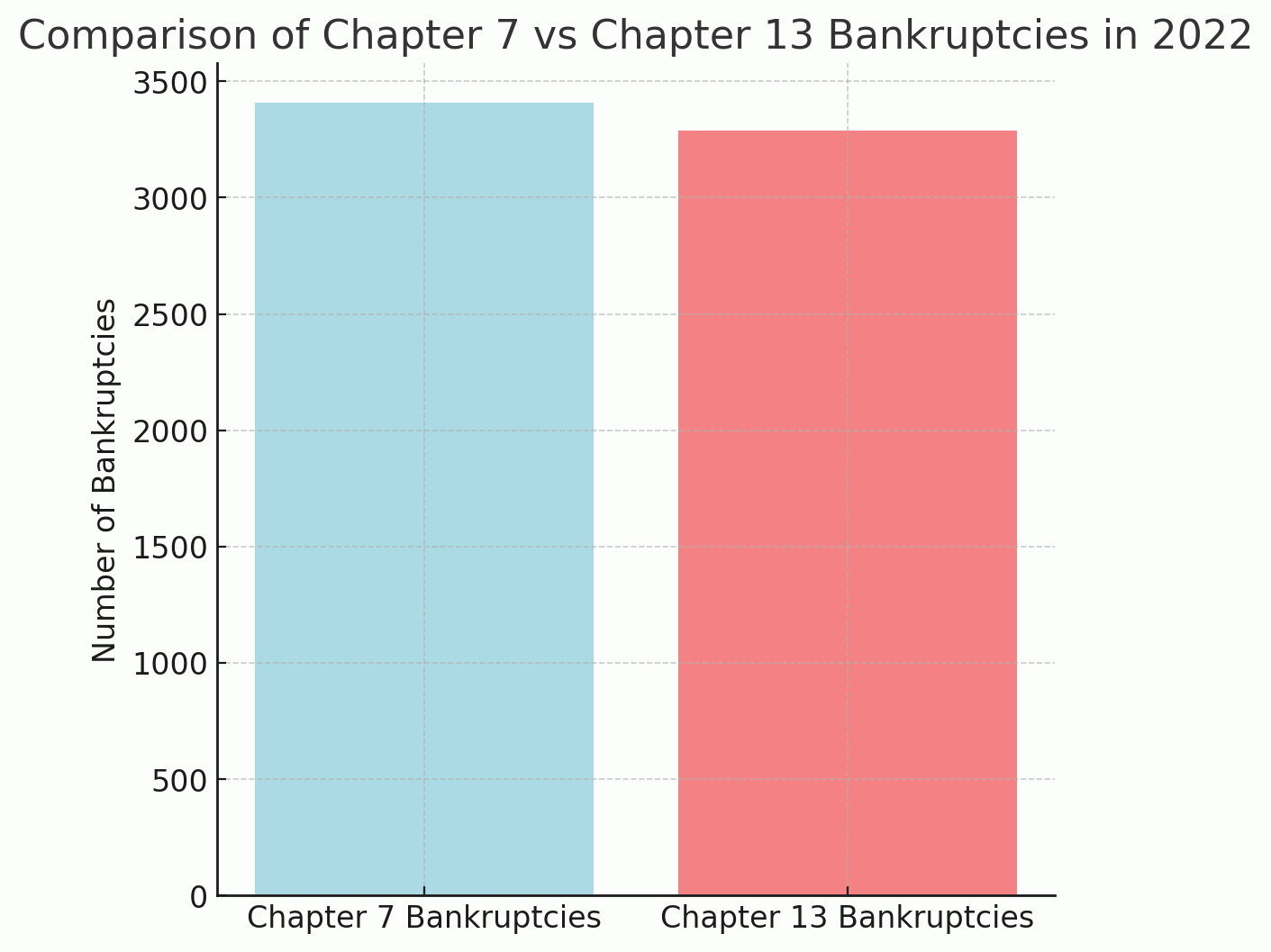

Infographic

Dallas Bankruptcy Statistics

According to the U.S. Bankruptcy Court Northern District of Texas, there were 6,860 bankruptcies in 2022. 3,407 of these were Chapter 7 bankruptcies and 3,287 were Chapter 13. Leinart Law Firm was built with a simple mission: give the people of Greater Houston the best legal representation at the lowest price possible. We are proud to serve our community, and we want to make sure that everyone has access to top-notch attorneys, regardless of their budget.

FAQs

Facing financial difficulties can be overwhelming, and bankruptcy may offer relief to individuals struggling with overwhelming debt. However, it’s essential to understand the implications and requirements of bankruptcy before proceeding. At Leinart Law Firm, we’re here to provide clarity and guidance to individuals considering bankruptcy as a debt relief option. Below, our Dallas bankruptcy lawyer addresses some frequently asked questions to help you better understand bankruptcy law and how it may apply to your situation.

How Do I Know If Bankruptcy Is The Right Option For Me?

Determining whether bankruptcy is the right choice requires careful consideration of your financial circumstances. If you’re struggling to pay your bills, facing foreclosure or repossession, or being harassed by creditors, bankruptcy may offer a fresh start. Consulting with our bankruptcy attorney can help you evaluate your options and determine if bankruptcy is the best solution for your situation.

Will I Lose All My Possessions If I File For Bankruptcy?

Contrary to common misconceptions, filing for bankruptcy does not necessarily mean losing all your possessions. In many cases, bankruptcy exemptions allow individuals to retain essential assets such as their home, car, and personal belongings. Additionally, exemptions vary by state, and a skilled bankruptcy attorney can help you maximize the protection of your assets under Texas bankruptcy laws. Your attorney will also be able to list out what you can and cannot keep, and there are also multiple types of bankruptcy so that you can file the one that best suits your situation.

What Is The Means Test In Bankruptcy?

The means test is a crucial component of Chapter 7 bankruptcy eligibility. It evaluates your income and expenses to determine if you qualify for Chapter 7 bankruptcy, which allows for the discharge of certain debts. If your income is below the state median, you may automatically pass the means test. However, if your income exceeds the median, further analysis of your expenses and financial situation will be necessary to determine eligibility. Your attorney will be able to run through this with you.

Can I Keep My Retirement Accounts If I File For Bankruptcy?

In most cases, retirement accounts are protected from creditors during bankruptcy proceedings. Funds held in qualified retirement accounts such as 401(k)s, IRAs, and pension plans are typically exempt from bankruptcy and cannot be used to satisfy creditors’ claims. It’s essential to disclose all retirement accounts to your bankruptcy attorney to ensure they are properly protected under the law.

Will Bankruptcy Stop Creditors From Harassing Me?

Yes, one of the significant benefits of filing for bankruptcy is the automatic stay, which immediately halts most creditor actions, including collection calls, lawsuits, wage garnishments, and foreclosure proceedings. The automatic stay provides immediate relief from creditor harassment and gives you the opportunity to address your financial situation without constant pressure from creditors. If you file for bankruptcy and creditors are still harassing you, reach out to your attorney so they can remedy the situation.

Dallas Bankruptcy Glossary

Since 2005, our Dallas, TX bankruptcy lawyer at Leinart Law Firm has provided valuable insight into the legal process. We strive to present a clearer understanding of bankruptcy concepts and how they apply to individuals seeking financial relief through legal means.

Automatic Stay

An automatic stay is a powerful protection granted to debtors immediately upon filing for bankruptcy. It is a court-ordered injunction that temporarily stops creditors from pursuing collection actions, lawsuits, wage garnishments, foreclosures, repossessions, and harassing phone calls. This stay provides the debtor with breathing room to reorganize their financial affairs without the pressure of ongoing collection efforts. However, creditors may petition the court to lift the stay in specific circumstances, such as when a debtor has filed multiple bankruptcy cases in a short period. Violating the automatic stay can result in legal penalties against the creditor.

Bankruptcy Estate

The bankruptcy estate consists of all legal or equitable interests in property that belong to the debtor at the time of filing for bankruptcy. This includes real estate, bank accounts, vehicles, personal possessions, and even potential lawsuits or claims the debtor might have. The estate is created upon filing the bankruptcy petition and is placed under the control of a court-appointed trustee. The trustee’s role is to manage and distribute the assets of the estate to creditors according to bankruptcy laws. Some assets may be considered exempt, meaning they cannot be taken to pay off debts, while nonexempt assets may be sold to satisfy outstanding obligations.

Discharge

A discharge is the ultimate goal for many bankruptcy filers, as it releases them from personal liability for most of their debts. Our Dallas bankruptcy lawyer knows that once a debt is discharged, creditors can no longer take legal action to collect it, including lawsuits, wage garnishments, or even contacting the debtor. However, not all debts are dischargeable. Obligations like student loans (in most cases), child support, alimony, certain tax debts, and debts incurred through fraud generally remain the debtor’s responsibility. A discharge does not erase liens on secured assets, meaning a creditor with a mortgage or car loan may still repossess the collateral if payments are not maintained.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy, also known as “liquidation bankruptcy,” allows debtors to eliminate most unsecured debts, such as credit card balances, medical bills, and personal loans. A court-appointed trustee oversees the process, selling off the debtor’s nonexempt assets to repay creditors. However, many filers can keep essential property, such as a primary home, vehicle, and household items, due to state and federal exemption laws. The process typically lasts three to six months and provides a relatively quick resolution for those overwhelmed by debt. According to our experienced Dallas bankruptcy lawyer, not everyone qualifies for Chapter 7. Debtors must pass a means test, which examines their income and expenses to determine eligibility.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy, often called the “wage earner’s plan,” is designed for individuals with a regular income who want to reorganize their debts and make manageable payments over time. Instead of liquidating assets, the debtor proposes a repayment plan, usually lasting three to five years, under the supervision of the bankruptcy court. This type of bankruptcy allows individuals to catch up on mortgage arrears, prevent foreclosure, and retain valuable assets while repaying a portion of their debts. The amount paid back depends on income, expenses, and the total debt owed. If the debtor completes the repayment plan successfully, any remaining eligible debt may be discharged.

Leinart Law Firm, Dallas Bankruptcy Lawyer

10670 N Central Expwy Suite 320 Dallas, TX 75231

Contact Us Today

Many people are concerned that filing for bankruptcy ruins them financially for life. It comes with consequences such as lowering your credit score, making it difficult to file loans, and other penalties. However, the reality is a little more complex. Bankruptcy can actually be the best financial option for people in certain situations. It gets rid of their debt, or makes it more manageable. This allows them to have a clear slate so that they can start fresh. Filing for bankruptcy does come with setbacks, but it can make you much better off in the long run.

Do not hesitate if you are considering filing for bankruptcy or having deep financial difficulties. Our skilled bankruptcy lawyer at the Leinart Law Firm has plenty of experience doing this with others and can help you decide how you want to move forward and what the best chance at recovering quickly from filing will be. Reach out today to set up a consultation to learn more.

Client Review

“Mr. Leinart is a caring and dedicated person as are the other lawyers and staff with whom you will be working. If you have to take this step, you cannot do better than Marcus Leinart.”

Daniel O’Dunne