Loan Modification Lawyer Texas

If you want to modify the terms of your mortgage loan, you may want to consult a Texas loan modification attorney. A mortgage modification can help you remain in your home. It is a change to the repayment terms on your current home loan that reduces your monthly payment.

If you want to modify the terms of your mortgage loan, you may want to consult a Texas loan modification attorney. A mortgage modification can help you remain in your home. It is a change to the repayment terms on your current home loan that reduces your monthly payment.

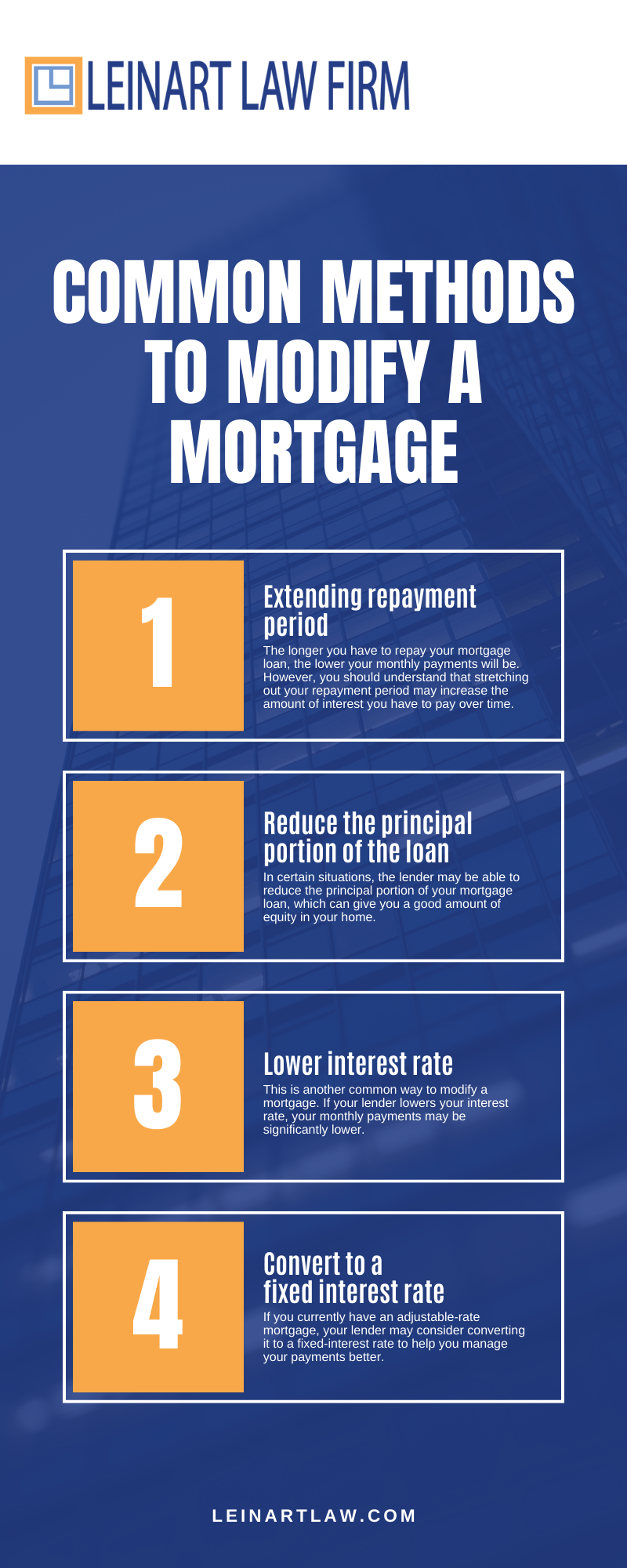

Common Methods to Modify a Mortgage

The main goal of a mortgage loan modification is to avoid foreclosure. Mortgage lenders may use several methods to modify a mortgage, including:

- Extending repayment period. The longer you have to repay your mortgage loan, the lower your monthly payments will be. However, you should understand that stretching out your repayment period may increase the amount of interest you have to pay over time.

- Reduce the principal portion of the loan. In certain situations, the lender may be able to reduce the principal portion of your mortgage loan, which can give you a good amount of equity in your home.

- Lower interest rate. This is another common way to modify a mortgage. If your lender lowers your interest rate, your monthly payments may be significantly lower.

- Convert to a fixed interest rate. If you currently have an adjustable-rate mortgage, your lender may consider converting it to a fixed-interest rate to help you manage your payments better.

Loan Modification Infographic

How to Qualify for a Loan Modification

If you want to see if you qualify for a loan modification, you may want to get in touch with a loan modification attorney, like one from Leinart Law Firm. An experienced Texas loan modification attorney can assess your situation and determine if you may qualify for a loan modification or not. Generally, you have to be at least one mortgage payment behind and show evidence that you have a major financial hardship, such as the death of a family member, long-term illness, or divorce.

How Loan Modification Can Impact Your Credit Rating

If you are considering a loan modification, you might wonder how it will affect your credit score. Since lenders often report your loan modification to the national credit bureaus, your credit rating may take a hit. However, it is important to recognize that the impact on your credit score will be less severe than a foreclosure. You will have the opportunity to rebuild your credit rating over time.

How Loan Modification Differs from Refinancing

Some people may use the terms loan modification and refinance interchangeably. However, they are different. Refinancing allows you to replace your current mortgage loan with one that has a lower interest rate or longer term and does not negatively impact your credit.

However, those who are experiencing financial hardship might not qualify for refinancing because of their low credit score or reduced income. In these situations, the homeowner may only qualify for a loan modification.

If you have additional questions about loan modification, you should schedule a meeting with a Texas loan modification attorney from Leinart Law Firm today to talk about your case in detail.

Common Misconceptions About Loan Modification

If you are having trouble paying your mortgage, you may want to consult a Texas loan modification lawyer. You may qualify for a loan modification, which can change one or more of the terms of your existing loan. Here are some common misconceptions about loan modification that you should not believe. Read about those, and then contact us at Leinart Law Firm for help today!

- I must be late on my mortgage payments to qualify for loan modification. Although you might have a more difficult time getting approved for loan modification when you’re not behind on payments, it is not impossible. You have to establish that you are experiencing severe financial hardship, whether it is due to a job loss or divorce.

- If I file for bankruptcy, the lender will not modify my loan. If you are deep in debt, you may be thinking about filing for bankruptcy. However, you may be worried that your lender will not modify your loan if you file. The good news is that declaring bankruptcy with a Texas loan modification lawyer will not necessarily prevent you from getting your loan modified. As long as you continue paying your agreed-upon payments, you may get your loan modification approved.

- If I have poor credit, I’m not eligible for a loan modification. Unfortunately, some homeowners are reluctant to apply for a loan modification because they do not have good credit. They assume that they will not get approved. Your credit score has no bearing on your loan modification. On the other hand, if you would apply for refinancing, you would have to have a credit check.

- I will get my principal reduced no matter what. Although you might be able to get your principal reduced, it is not a sure thing.

- If I can’t afford my mortgage, I should not apply for a loan modification. If you have little to no income, you may not be able to afford your mortgage. However, if your current income is close enough to being able to afford your monthly mortgage payment, it may be worth it to apply for a loan modification. You may be able to get a second job for the time-being to qualify for a loan modification.

- If the bank rejected my loan modification application, that is it. If the bank denied your initial application, you might assume that you have to consider other options. However, you may be interested to know that the majority of initial loan modification applications are rejected. Just because your application got denied the first time around, does not mean that you have to give up. For instance, if your application was denied because your income is too low, you may be able to document income that you don’t report to the IRS, like rent you receive from family members. Even if it is just a little bit of extra money a month, it may help you get your application approved. A Texas loan modification lawyer can help you reply for the loan modification, so contact one today at Leinart Law Firm!

What if We Hit a Dead End with My Lender?

Although our Texas loan modification lawyer team understands how to get results, no ethical attorney would ever presume to “guarantee” the outcome of any particular legal matter. As a result of the fact that sometimes things just don’t work in the favor of an individual’s concerted efforts – usually due to hardline lender policies and ultra-specific loan modification policies – you may be understandably wondering what “Plan B” will be in the event that your attempts to secure a loan modification successfully are thwarted by your lender’s response.

Thankfully, the knowledgeable legal team at Leinart Law Firm understands how to get results for homeowners who are struggling with debt, even if a loan modification isn’t the best way forward or isn’t achievable under the circumstances. The primary “Plan B” options for homeowners who need mortgage relief but who can’t secure a loan modification fall into two categories: bankruptcy and bankruptcy alternatives.

Filing for Bankruptcy

As our Texas loan modification lawyer team can explain in greater detail in a risk-free consultation setting, homeowners benefit from the protections of the automatic stay as soon as they file for bankruptcy. They automatic stay halts legal and collection action against debtors under most circumstances. This protection remains in place for the life of an individual’s bankruptcy case.

Meaning, if you choose to file for bankruptcy, creditors have to stop harassing you, threatening foreclosure, garnishing your wages, etc. until your bankruptcy case has been resolved or dismissed. As a result, many homeowners are able to utilize these protections to their advantage for years at time.

If you file for Chapter 13 bankruptcy, you’ll reorganize your debt to make repayment more manageable. You’ll then spend between three and five years making a single manageable monthly payment on your consolidated and reorganized debt. As long as you make these payments per the term of your bankruptcy agreement, your home will not be at risk of foreclosure. You’ll also be able to use this time to get caught up on overdue mortgage balances and to stabilize your finances generally so that your future is far more stable.

Bankruptcy Alternatives

If filing for bankruptcy isn’t the best way forward for your unique circumstances, know that there are alternatives to both bankruptcy and loan modification that we can explore. For example, refinancing your mortgage may both help to make your repayment situation more manageable and may even allow you to benefit from more favorable terms than you’ve been provided with via your original loan paperwork.

At the end of the day, you can rest assured that the dedicated Texas loan modification lawyer team at Leinart Law Firm will do our utmost to secure the most favorable outcome to your case that is possible under the circumstances. Every homeowner’s financial situation is unique. Our team will ensure that our guidance and assistance is tailored to your experience in an effort to help you move forward on solid financial ground. We look forward to speaking with you.

Loan Modification Lawyer Texas

If you are in need of legal assistance regarding your mortgage situation, contact a Texas loan modification lawyer clients can trust.

Loan Modification Lawyer FAQs

What is a loan modification lawyer?

A loan modification lawyer is an attorney who has experience and training in mortgages and other loans. They work with their clients to modify the terms of their mortgages and loans to the benefit of the client. If clients are trying to avoid foreclosure, modifying their mortgage may help them in that endeavor. Loan modification lawyers have the insight, education, and experience to assist their clients as they work toward healthier financial situations. The attorneys at Leinart Law Firm desire their clients’ well-being and will work hard to help them achieve their financial goals.

How can a loan modification lawyer assist their clients?

A loan modification lawyer can assist their clients in a number of different ways. For example, if a client is in severe debt, a loan modification lawyer can come up with helpful strategies for mitigating that debt or paying it off. Some of those helpful strategies may include modifying mortgages and recommending filing for bankruptcy if it is in the best interest of the client. Attorneys who focus on loan modification can also help their clients increase their credit scores, even after bankruptcy and mortgage modification. Clients should be encouraged to find a loan modification lawyer who can serve them and their financial situation well.

What is considered foreclosure?

Foreclosure occurs when homeowners have to relinquish their ownership of their house due to negligent mortgage payments. Foreclosure can undoubtedly be devastating for homeowners, especially if they have children. Loan modification lawyers will work hard to help their clients avoid foreclosure by modifying their loans, and recommending bankruptcy if that is in the best interest of their clients. Every client is unique in their financial status, debt, and mortgage. Part of a loan modification lawyer’s job is to assess their client’s specific situation and recommend the best course of action. That is why it is crucial to have an experienced attorney whom you can trust.

When should clients contact a loan modification lawyer?

Clients should contact a loan modification lawyer whenever they wish to modify their mortgage, loan, or financial situation. Before foreclosure is determined, homeowners should seek out the legal assistance of a loan modification lawyer. The sooner the better for financial success, and avoidance of foreclosure. Loan modification can also be a helpful tool when clients are trying to avoid bankruptcy. Some may hesitate to contact an attorney for fear or embarrassment of their financial struggle and situation. However, loan modification lawyers are non-judgemental, and any and all conversations with them are strictly confidential.

How are loan modification and refinancing different?

While some may think that refinancing and loan modification are the same, and therefore interchangeable, they are actually different from one another. Refinancing can change the interest rate and length of a mortgage which will allow for a lower rate for the homeowner without altering their credit. Refinancing may not be an option for everyone as homeowners must qualify for it. Those with lower credit scores, or struggling financially may not qualify for refinancing, but can still benefit from a loan modification. Contact a loan modification lawyer today and find out what your best financial options are.

Can I face a mortgage modification scam?

If you find that you have been caught in a mortgage scam, you should contact a Texas loan modification lawyer. One of the most important elements to know about loan modification is that you should not discuss your loan modification with anyone other than your mortgage lender. In today’s world, there are countless scammers out there targeting homeowners who are behind on their home payments. These scams can simply start off as a phone call, piece of mail, etc. The upside to scammers trying to contact you is that it can be easy to identify them. Should you receive solicitation from any said company, search the internet to verify their history and their business. Once you know it’s a fake company trying to contact you, you should not respond to them at all.

Are there disadvantages to loan modification?

You want to be hyper aware of where your finances will be in the long run, because oftentimes a loan modification includes the possibility of having to pay more money over time than you originally owed. While a loan modification gives you more time to find financial stability, it’s not the best case scenario for certain homeowners, depending on where your personal finances are at. You also want to be aware of the extra fees to modify a loan and your credit score may be impacted. Because of these factors, if you do modify your loan, it’s essential you stay on top of your loan payments in the future.

How is loan modification different from forbearance?

A forbearance is different from a loan modification in that a forbearance is a temporary and intended to help a homeowner through a short-term financial challenge. More specifically, a forbearance is usually a negotiation with a lender that allows the homeowner to skip payments for a predetermined period of time. It’s important to know that these suspended payments may be due in one lump sum after the forbearance period, so depending on your personal financial situation, forbearance may or may not be right for you. A Texas loan modification lawyer can help you make these kind of critical financial decisions.

Is the length of time for a loan modification worth it?

Loan modifications may be just what you need if you find yourself unable to pay your mortgage payments, but unfortunately the process can be intimidating, which is why working with a loan modification lawyer can be worth it. Loan modifications do require a heavy amount of paperwork along with sometimes a lengthy timeline to complete the process. Despite what may feel like a daunting procedure, consulting a Texas loan modification lawyer is important for homeowners in discerning whether loan modification is right for them.

What qualifies for a loan modification?

Eligibility requirements will vary depending on the lender for a loan modification. Sometimes a lender may require at least one missed and late mortgage payment before allowing loan modification, and they also will likely evaluate what hardships you are facing that caused these delayed payments. Proof of hardship most commonly include: divorce, loss of income, increase in housing costs, natural disaster, a pandemic, or an illness or disability. If you are facing any of these hardships, contact your lender immediately.